How do I change my payment information?

This article will explain how to change your payment information.

1. Click on your account ID at the top-right of the screen and select Payment Settings.

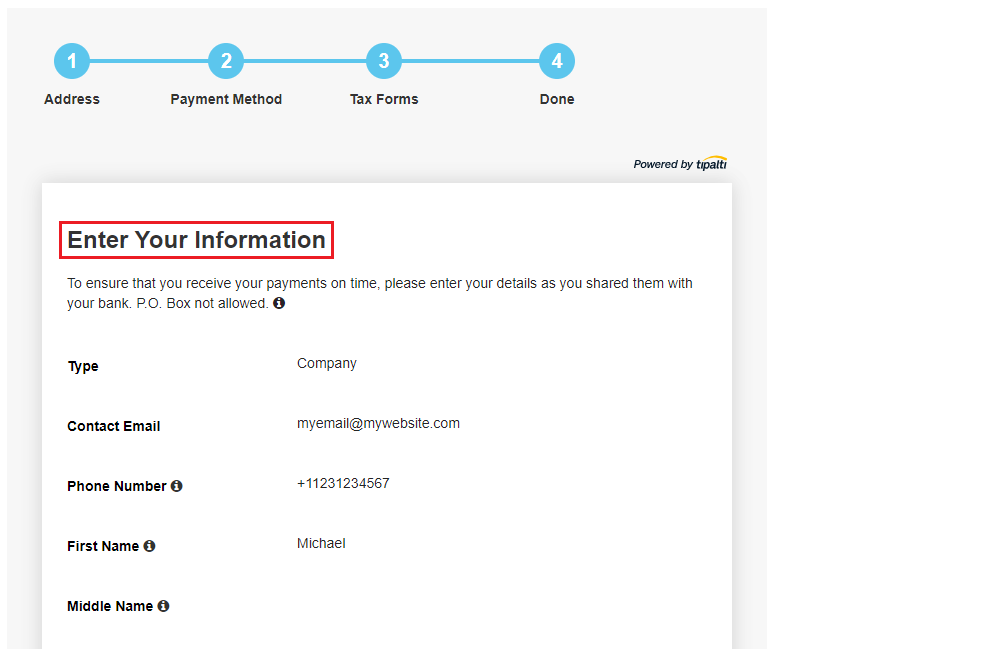

2. Confirm that your contact information is correct and click the Next button at the bottom of the page. If you need to change your information, click the Edit button first, make your changes, and then click the Next button.

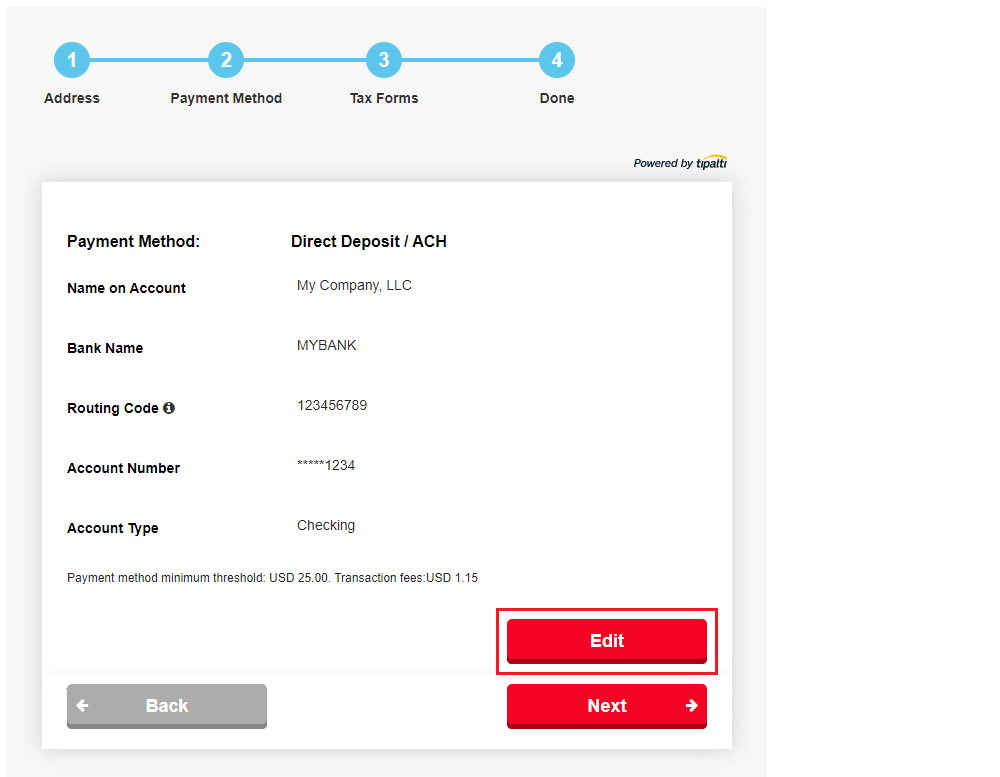

3. On the Payment Method page, click the Edit button.

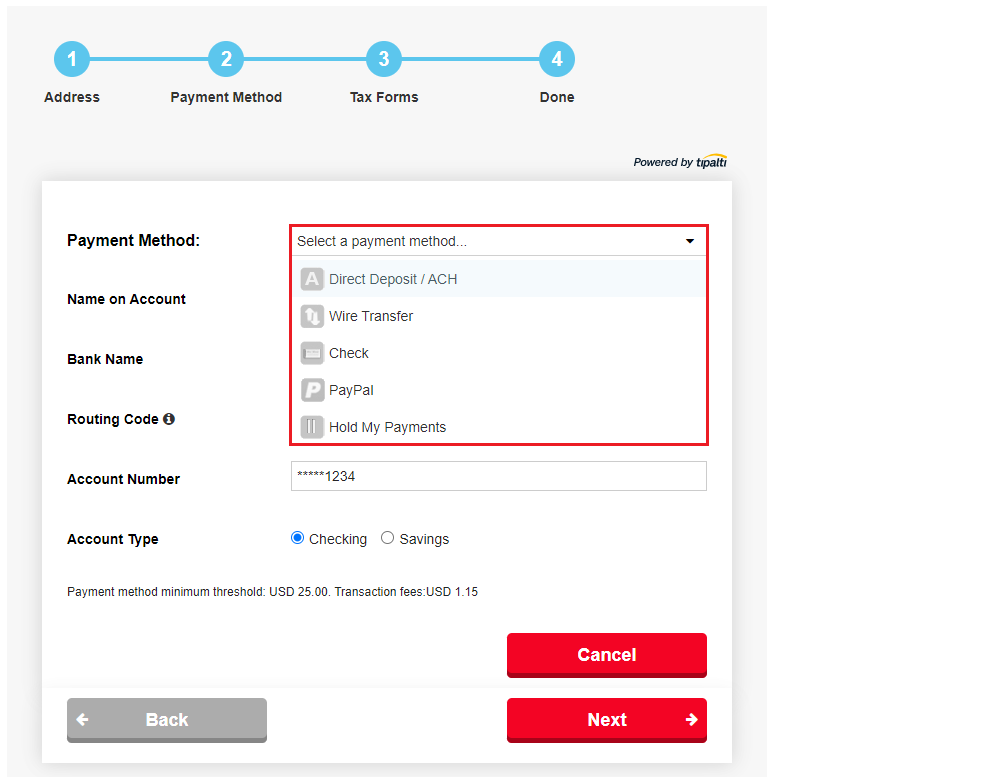

4. Click the dropdown menu next to Payment Method, select how you want to be paid, and fill in the required information.

Note: If you select the Hold My Payments option, it will allow you to choose to hold any payments being made so that earnings can accrue until they are ready to be paid. Once you are ready to receive payment, you will need to log back into your publisher account and change the payment method to one of the available methods.

If you need to go back and change the previously entered information, click the “Back” button. If you are ready to move on to the next page, click the “Next” button.

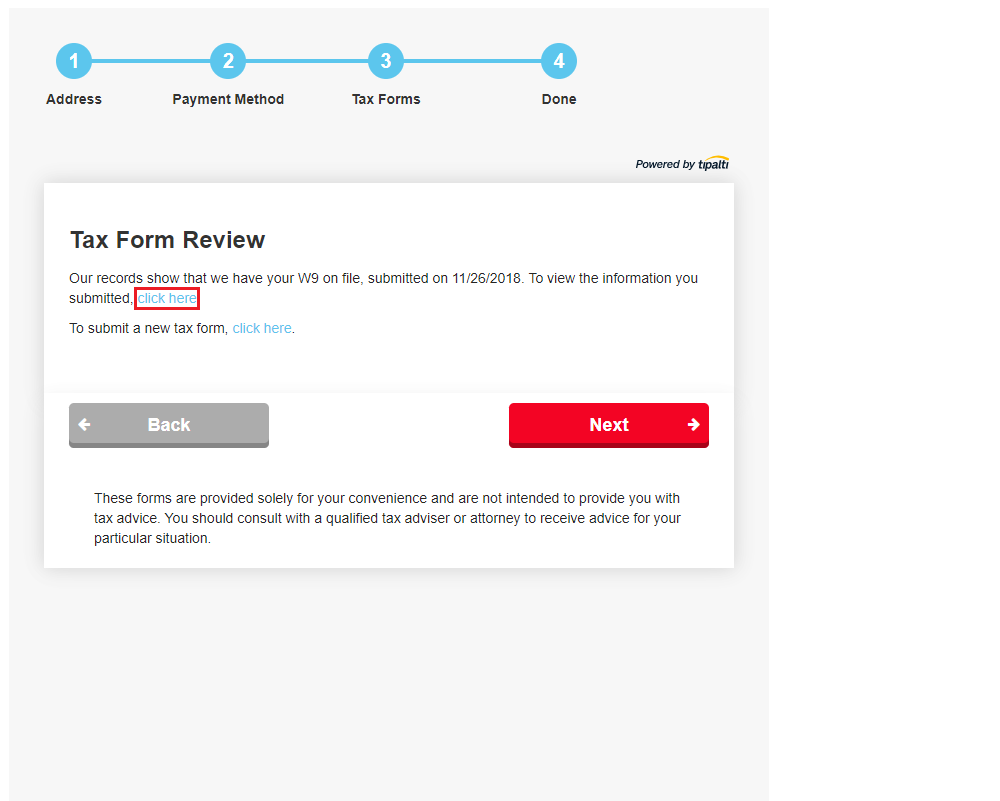

5. Click the Next button to access the Tax Form Review page. On this page, you can click to review the W9 you have on file - or submit a new tax form.

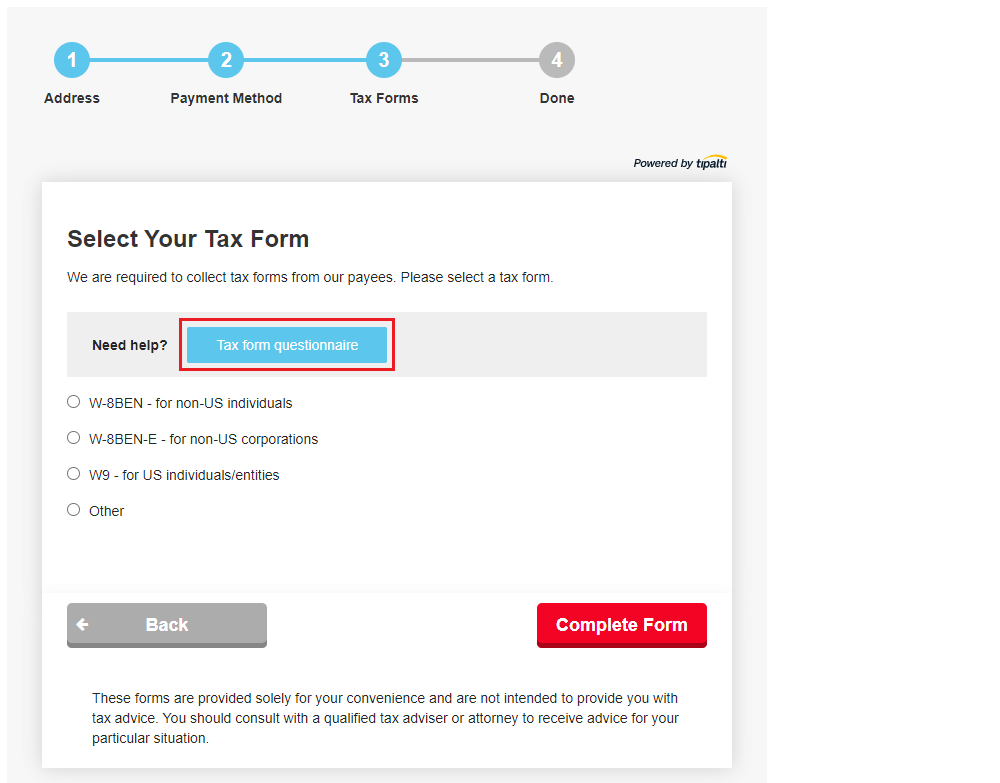

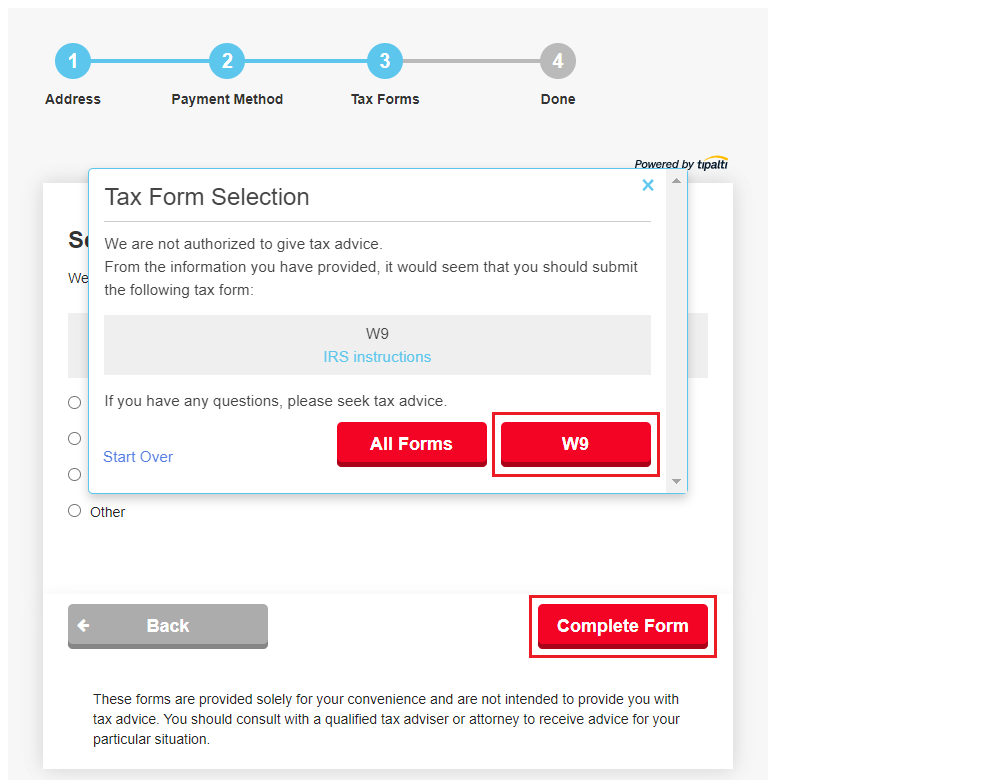

6. If you chose the option to submit a new tax form but you are not sure which tax form is right for you, click the "Tax form questionnaire" button answer a few questions that will help you select the appropriate form.

Note: FlexOffers.com will not provide tax advice, but the questionnaire should help you and direct you to what seems to be the appropriate tax form based on the information you provide.

For example, if you confirm that the W9 is the appropriate tax form, you will click the W9 button and then click the Complete Form button.

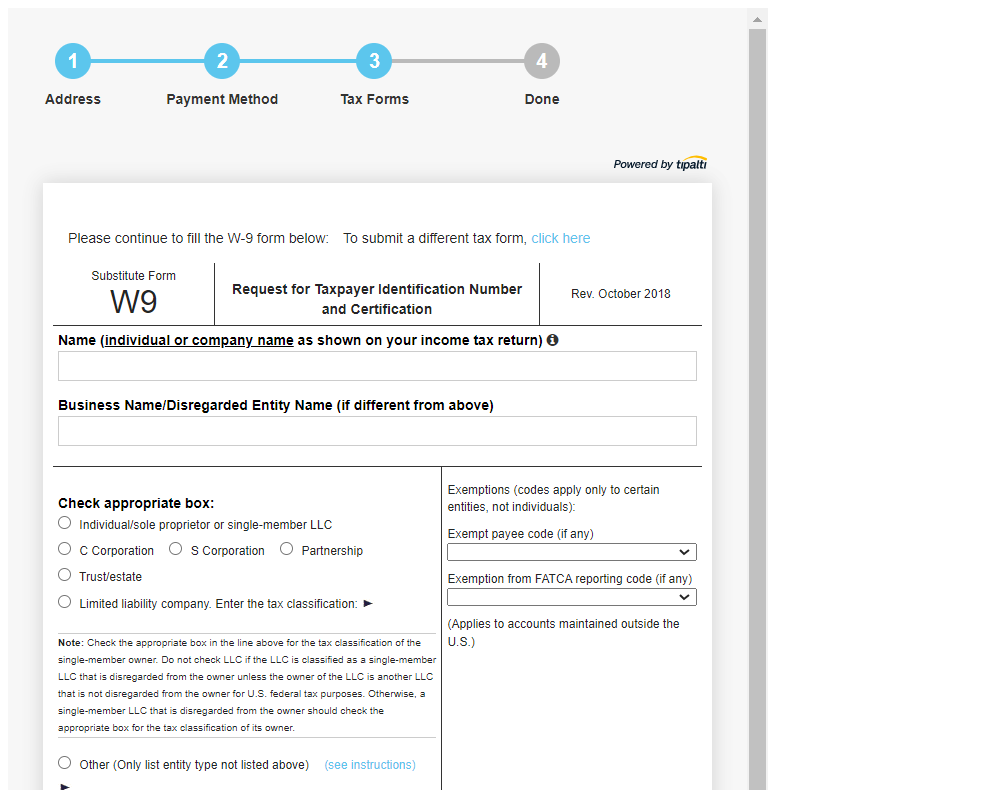

This will then direct you to the to the electronic version of the W9 tax form.

After you fill in the applicable fields in the top section and Part I, you will need to read through and digitally sign the W9 tax form by typing your name and contact email address.

NOTE: You will need to make sure that the name and contact email are the same as what they completed on page 1 of the Payee registration process.

Once finished, the Payee will click on the “Next” button to finalize their registration steps.

Payment services provided / Thresholds / Fees

| Payment Type | Fee | Monthly threshold (USD) | Description |

| Check | $3 / Payment | $25 | Check price includes printing, mailing and check clearing. |

| Local Bank Transfer | $1 / Payment | $25 | Available only if Customer is incorporated in the US and making payments in the US, or a company incorporated in the EU and making payments in the EU. Available in USD and EUR currency only. |

| Local Bank Transfer (UK) | $1.5 / Payment | $25 | Available only if Customer is incorporated in the UK and making payments in the UK. Available in GBP currency only. |

| International ACH | $5 / Payment | $25 | International ACH, also known as eCheck. |

| Wire Transfer - U.S | $15 / Payment | $1,000 | Wire transfer to U.S. Payee account. |

| Wire Transfer - Non-US in USD | $26 / Payment | $1,000 | Wire transfer to non-U.S. Payee account in USD. |

| Wire Transfer - Non-U.S., non-UDS | $20 / Payment | $1,000 | Wire transfer to non-U.S. Payee account, not in USD. |

| PayPal | $1 / Payment | $25 | Provider transaction fees apply. |

In which currency can I get paid?

The available payment currencies differ per country and payment method. Most of the major currencies across the world are available, including many local currencies. When you add your address and payment information in the Payee Dashboard, you can select a currency from the list of applicable currencies.

Once I've registered in the Payee Dashboard, can I update my information?

Yes, but please be aware that a change in any of the following information may erase banking information and/or invalidate tax forms.

- First name

- Last name

- Company name

- Contact address country

- Payment details country

- Phone number

Note: A change in letter case to your name (e.g., "amy" to "Amy") will not invalidate your tax form.

Who is Tipalti?

Tipalti offers a payment automation platform that unifies all phases of publisher payments. From publisher tax on-boarding to payment method selection and funds disbursement. For more information click HERE.